SUNY Appoints New President for SUNY Sullivan

Theater Program Presents Fairview and Fuenteovejuna/The Sheep Well

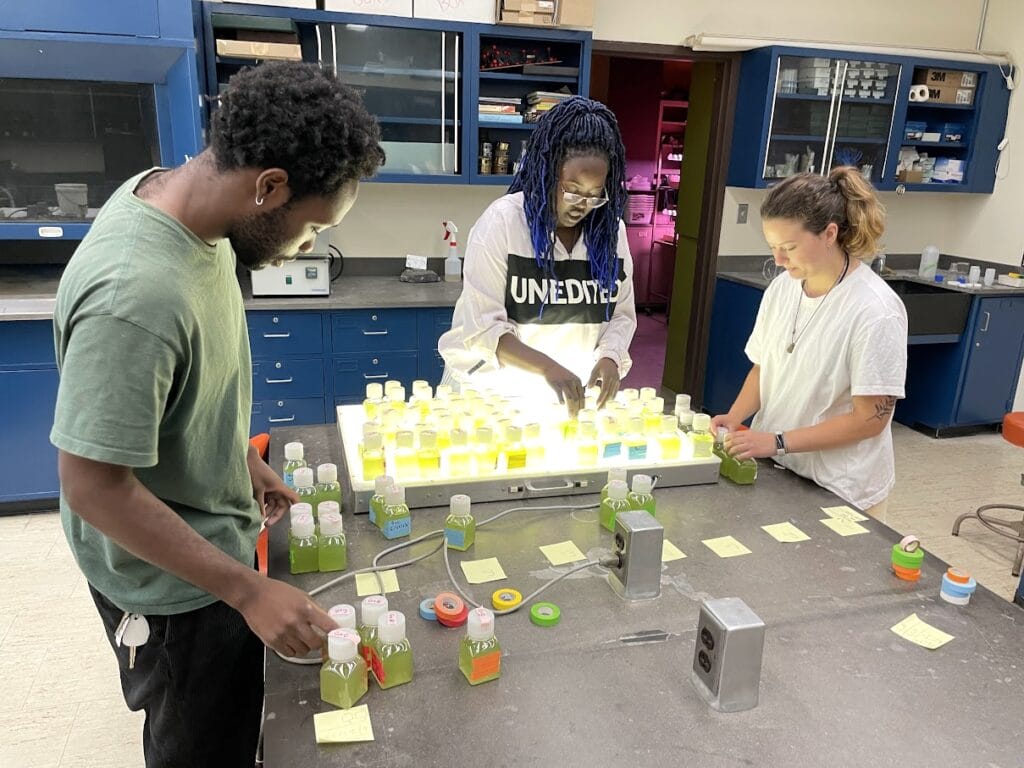

Green Building Technology Student Dominique Etienne Presents Algal Bloom/CyanoHAB research at Biomedical Research Conference in Phoenix

WEEKENDS (8 weeks) Sat. & Sun. (7:00 a.m.-5:30 p.m.) COST: $5,500 Click HERE to register! […]

DAYTIME (3 weeks) Mon.-Thurs. (7 a.m.-5:30 p.m.) COST: $4,125 Click HERE to register! NOTES: Training […]

Get certified in food safety with our ServSafe® Food Manager Certification Training & Exam – […]

Make healthy snacks and drinks in H058. Fun hands-on learning! All safety and sanitation guidelines […]

A Better Future - Within Reach

0+

Degree programs & certifications<$0

Tuition a year0

Acre campus$0 M+

Financial aid awarded annually0+

Degree programs & certifications<$0

Tuition a year0

Acre campus$0 M+

Financial aid awarded annuallyExperience SUNY Sullivan

SUNY Sullivan is a forward-looking, top-tier community college in New York offering over 40 degree programs, certificates, and micro-credentials for learners at all levels of their educational goals. Our 405-acre campus provides a living sustainability lab with an organic farm, geothermal heating and cooling, solar farm, wind turbine, and apiary. We are committed to environmental and social responsibility that informs our campus operations and curriculum. Whether from an urban environment or local hometown, our students benefit from our mindbody wellness initiatives and excel in championship Division II Athletics programs.

Follow Us

Sign up to receive email updates about SUNY Sullivan.